Which Company Provides the Best Motor Insurance Coverage for Cars?

(Photo Credit: Pixabay)

(Photo Credit: Pixabay)

In Singapore, it is mandatory for drivers to be covered by a motor insurance policy. But with so many different insurance plans out there, which one provides the best coverage? Here are our top picks for the best car insurance coverage in Singapore.

There are three main types of motor insurance, namely:

- Third Party Only (TPO)

- Third Party, Fire and Theft (TPFT)

- Comprehensive

There is also a No-Claim Discount (NCD) that each insurance company provides to their policyholders. This is a discount that grows by 10% every year that you don’t make a claim. The maximum NCD is 50%, and is non-transferable between companies and entities.

1. NTUC Income (Drivo)

(Photo Credit: NTUC Income)

(Photo Credit: NTUC Income)

One of our partners, and a very widely known insurance company, NTUC Income provides good coverage for your vehicle. With four plans for you to choose from, as well as add-ons, you can get the best deals for your budget. Here’s a look at NTUC’s car insurance plans:

|

Name of Plan |

What It Covers |

|

Third Party Only (TPO) |

Damage for third parties. |

|

Third Party, Fire and Theft (TPFT) |

Damage for third parties, and damage caused by fire and/or theft. |

|

DrivoTM Classic |

Damage inflicted on the driver’s vehicle if it is stolen/involved in an accident. Covers floods as well. |

|

DrivoTM Premium |

Similar to Classic, but allows repairs at your preferred workshop. Covers floods as well. |

|

DrivoTM Prestige |

Similar to Premium, but only for Porsche car owners. |

Let’s take a quick look at the Comprehensive plans NTUC offers.

|

DrivoTM Classic |

DrivoTM Premium |

DrivoTM Prestige |

|

|

Loss/damage to your vehicle from accidental cause, fire or theft |

✓ |

✓ |

✓ |

|

Damage to third party property |

✓ |

✓ |

✓ |

|

Windscreen cover (unlimited) |

✓ |

✓ |

✓ |

|

Medical Expenses |

✓ |

✓ |

✓ |

|

Towing service (up to S$500) |

✓ |

✓ |

✓ |

|

Policy excess |

S$600 |

S$600 |

S$5,000 (within Singapore) S$8,000 (outside Singapore) |

For the full coverage list, please visit NTUC Income’s website.

NTUC has a standard excess of S$600 for Classic and Premium plans, but what if you can’t afford the S$600 on short notice? You could choose to get an add-on for that!

|

Add-On |

Description |

|

Excess Waiver |

Waives the S$600 basic excess. Only applicable to DrivoTM Premium and DrivoTM Classic. |

|

NCD Protector |

Only for drivers with NCD at 30% or above. |

|

Daily Transport Allowance |

Applicable for your first two claims. This cover pays S$50 a day, from the first day of repair up to 7 days. |

NTUC is also well known for Orange Force, their 24/7 accident response team. They’re there to provide roadside assistance and advice for policyholders who get into an accident. Orange Force is contactable by phone.

2. Etiqa Insurance

(Photo Credit: Etiqa Insurance)

(Photo Credit: Etiqa Insurance)

The second of the three companies that Motorist works with, Etiqa offers the basic three plans – TPO, TPFT and Comprehensive. No premium versions, just the simple basic coverage, which is sometimes more than enough for many drivers!

Name of Plan |

What It Covers |

Third Party Only (TPO) |

Damage for third parties. |

Third Party, Fire and Theft (TPFT) |

Damage for third parties, and damage caused by fire and/or theft. |

Comprehensive |

Damage inflicted on the driver’s vehicle if it is stolen/involved in an accident. |

These plans come with adjustable excess, meaning you are allowed to change your excess amount to fit your budget. This is free for the Comprehensive plan, but is an add-on for TPO and TPFT plans. For more details, please visit their website.

Besides flexible excess, Etiqa offers several other add-ons, some of which other companies don’t offer, which makes Etiqa stand out.

Add-On |

Description |

Adjustable Excess |

Lets you choose your excess amount according to your budget. |

NCD Protector |

Protects your NCD in event of a claim. |

Sun/Moon Roof Cover |

Coverage up to S$2,000 for your sun/moon roof. |

Workshop of Your Choice |

Lets you choose to repair your car at a workshop of your choice. |

Solar Film Cover |

Coverage up to S$1,000 for your solar film. |

The downside of Etiqa’s auto insurance is that there is no mention of 24/7 roadside assistance, nor is there an add-on for this. They also do not provide replacement cars should your car be damaged beyond repair in an accident.

However, Etiqa does have a weekly discount titled ‘Thank Etiqa It’s Friday (TEIF)’, where you can get up to 25% off your policy! Their promo codes change accordingly, so keep a close eye on their promotions page to get the best deals.

3. MSIG Insurance

(Photo Credit: MSIG)

(Photo Credit: MSIG)

MSIG is another company that works with Motorist to give you the best insurance quotes. So, what exactly does MSIG offer?

MSIG has two kinds of Motor Insurance – ‘Private Motor’ and ‘Usage Based Private Motor’. ‘Private Motor’ plans are the basic comprehensive car insurance policies, while ‘Usage Based Private Motor’ has plans that reward safe drivers (based on a special scoring model) with special benefits, and comes with a telematics device.

Name of Plan |

What It Covers |

MotorMax |

Basic comprehensive coverage for your vehicle. |

MotorMax Plus |

Similar to MotorMax, but with choice of workshop and other benefits. |

UMax |

Similar to MotorMax, but with a telematic device and coverage for loss of personal effects. |

UMax Plus |

Similar to UMax, but with choice of workshop and other benefits. |

Let’s take a look at some of the comparisons between the four plans.

MotorMax |

MotorMax Plus |

UMax |

UMax Plus |

|

Comprehensive Coverage |

✓ |

✓ |

✓ |

✓ |

Personal Accident (for policyholder) |

S$20,000 |

S$100,000 |

S$20,000 |

S$100,000 |

Personal Accident (for authorised driver and/or passenger) |

S$10,000 each |

S$50,000 each |

Up to S$10,000 each |

Up to S$50,000 each |

Choice of Workshop |

- |

✓ |

- |

✓ |

Transport Allowance |

- |

✓ |

- |

✓ |

New for Old Replacement |

- |

✓ |

- |

✓ |

Loan Protection Benefits |

- |

Up to S$100,000 |

- |

- |

Loss of Personal Effects |

- |

- |

✓ |

✓ |

Telematics Device |

- |

- |

✓ |

✓ |

That’s just a snippet of what MSIG offers! For the full list of benefits and comparisons, check out the MotorMax and UMax pages on their website.

‘Usage Based Private Motor’ plans reward drivers with savings on their premiums, as well as a waiver on their excess, provided that policyholders have installed the telematics device in their vehicle. You would have to travel to one of their VICOM workshops to install the device, but it would be really worth it in the end. Workshop locations will be sent together with policy documents once you have applied.

On another note, you do have to return the telematics device if and when you cancel your policy. This is because the device is property of MSIG, and they reserve the right to take it back. After all, the costs of installing the device are borne by them.

And of course, what insurance company doesn’t have add-ons? MSIG has only two add-ons for you, but this helps for policyholders who don't want to pay a super high premium.Add-On |

Description |

NCD Protector |

Protects your NCD at 30% or above. |

|

Vehicle Service in West Malaysia (only for UMax and UMax Plus) |

Allows coverage for loss of personal effects in West Malaysia (for one claim only), and Vehicle Location Service. This has an additional premium of S$53.50 (including GST). |

Overall, MSIG is a great company to consider if you prefer simplicity, or you want something slightly different, such as the telematics device.

4. DirectAsia Insurance

(Photo Credit: DirectAsia Insurance)

(Photo Credit: DirectAsia Insurance)

DirectAsia.com is a great choice to consider if you have gotten into an accident previously and are having trouble finding a company to buy insurance from. Why? DirectAsia has a special plan tailored just to help drivers get a second chance.

Let’s take a look at their plans:

Name of Plan |

What It Covers |

Third Party Only (TPO) |

Damage for third parties. |

Third Party, Fire and Theft (TPFT) |

Damage for third parties, and damage caused by fire and/or theft. |

Comprehensive |

Damage inflicted on the driver’s vehicle if it is stolen/involved in an accident. |

SOS Car Insurance |

Similar to Comprehensive, but for drivers who have gotten into accidents before. |

Alongside these policies, DirectAsia also has three Driver Plans for you to choose from. These are add-ons catered to policyholders who would like to add more drivers to their policy. For more details, you can check out their website.

Name of Driver Plan |

Description |

Value Plan |

Name up to 4 additional drivers (2 of them can be young and/or inexperienced) |

Value Plus Plan |

Covers main driver, unnamed experienced drivers and up to 2 young and/or inexperienced drivers |

Flexible Plan |

Protects any driver who drives the car; they need not be named as long as they have a valid driver’s license |

Adding on a Driver Plan will be super useful if you tend to lend your car to family members or friends. The Value Plan is the cheapest of the three, but if you’d like more extensive coverage, you may consider getting the Flexible Plan instead.

Speaking of add-ons, here’s the list of additional benefits you can stack onto your insurance plan!

Add-On |

Description |

24-Hour Breakdown Assistance |

24/7 roadside assistance should your vehicle break down. |

24 Months New for Old Replacement |

If your car is stolen or is damaged beyond repair, the same make and model of your car will be replaced. |

Compensation for Loss of Use |

You will get a daily transport allowance of S$50 per day (up to max. 10 days). |

My Workshop |

Opt to have your car repaired at a workshop of your choice. |

Medical Expenses |

Receive up to S$3,000 for yourself and any other passengers should you get into an accident. |

NCD Protector Plus |

Protect your NCD at 30% and above (applies to NCD60 as well). |

Repatriation Costs |

Offers S$200 per person and S$3,500 for towing from West Malaysia/Southern Thailand back to Singapore. |

Personal Accident |

Receive up to S$500,000 in case of death/loss of limbs of driver. |

My Accessories |

Coverage for LTA-compliant accessories that were damaged/stolen. |

Please take note that this is the overall view of the add-ons that DirectAsia offers and may not apply to all policies. To see which add-ons are applicable for the policy you intend on getting, check out more details here.

You might have noticed the term ‘NCD60’ in the add-on list. So, what exactly is NCD60?

NCD60 is a special feature offered by DirectAsia for policyholders who have managed to retain their NCD at 50% for five consecutive years. In simple words, you are eligible for NCD60 if you have not made a claim for the past 10 years of your policy. Drivers will also get a 10% discount on their premium.

While no other company offers this feature, it is more for seasoned drivers who are super careful on the roads. And to add on more great news, NCD60 is coverable by the NCD Protector Plus, which means that you can protect your NCD60 for one claim!

On top of all these great deals, DirectAsia also offers the TPO, TPFT and Comprehensive plans, but a Low Mileage version for drivers who drive Off-Peak Cars (OPC) or drive 8,000 km or less annually. To know more about the Low Mileage plans, please refer to this press release.

5. FWD Insurance

(Photo Credit: FWD Insurance)

(Photo Credit: FWD Insurance)

FWD Insurance provides the basic plans, as well as enhanced ones. Apart from TPO and TPFT plans, FWD has three different Comprehensive plans: Classic, Executive and Prestige.

Name of Plan |

What It Covers |

Third Party Only (TPO) |

Damage for third parties. |

Third Party, Fire and Theft (TPFT) |

Damage for third parties, and damage caused by fire and/or theft. |

Comprehensive Classic |

Damage inflicted on the driver’s vehicle if it is stolen/involved in an accident. |

Comprehensive Executive |

Similar to Classic, but with more perks. |

Comprehensive Prestige |

Similar to Executive, but with higher benefits. |

The Comprehensive insurance plans provide coverage to the owner/driver of the car, making it the most common insurance policy in the market. After all, most drivers would prefer to be covered as well should they get into an accident. Not sure which Comprehensive plan is the best for you? Here are some comparisons between the three plans.

Classic |

Executive |

Prestige |

|

24/7 Roadside Assistance |

✓ |

✓ |

✓ |

Damage to third party property |

✓ |

✓ |

✓ |

Windscreen Repair & Replacement (excess of S$100 for replacement) |

✓ |

✓ |

✓ |

Car Repair or Replacement if damaged by fire/stolen |

✓ |

✓ |

✓ |

Courtesy car (up to 3 months) |

- |

✓ |

✓ |

Automatic eligibility for Lifetime NCD Guarantee at NCD 50% |

✓ |

✓ |

✓ |

Medical Expenses |

S$1,000 |

S$3,000 |

S$5,000 |

That’s just a few of the highlights that FWD offers! For the full list of what FWD Comprehensive plans cover, please visit their website.

FWD is well-known for their Lifetime NCD Guarantee. It is a special feature given to customers who have accumulated a No Claim Discount (NCD) of 50%, meaning that they have not made a claim for five years.

Once the NCD has hit 50%, FWD automatically applies this extra feature, resulting in your NCD remaining at 50% forever, even if you make claims. It’s a good deal for experienced drivers to take up!

On top of having such a large coverage, you can opt to add on extra boosters to your insurance plan. Just keep in mind that every add on results in a higher premiumAdd-On |

Description |

Your Preferred Workshop |

This allows you to pick a workshop to service your car at instead of FWD premium workshops. |

Overseas Booster |

Provides additional cover when you drive in West Malaysia and parts of Thailand. |

NCD Protector |

For drivers who want to protect their NCD of 30% or 40%. (Only for one claim) |

Flexible Excess |

You can choose this option to pay a higher excess, thereby reducing your premium. |

Young Driver Excess Waiver |

Reduces your young driver excess. |

FWD also provides separate plans for Commercial cars, for those who are thinking about converting their car into a Private Hire Vehicle (PHV).

While FWD Insurance is trusted and one of the top insurance companies in Singapore, it is quite pricey. But cost aside, you do get one of the most extensive coverages in the market for your vehicle, making this a very worthy pick.

6. Aviva Insurance

(Photo Credit: Wikipedia)

Aviva is an insurance company that doesn’t provide TPO or TPFT plans, but rather three Comprehensive plans that cover both drivers and third parties. Let’s take a quick glance at the plans:

Name of Plan |

What It Covers |

Motor Lite |

Basic comprehensive coverage |

Motor Standard |

Similar to Lite, but with higher benefits |

Motor Prestige |

Similar to Standard, but with higher benefits, eCall assistance, and choice of workshop |

Motor Lite |

Motor Standard |

Motor Prestige |

|

Brand new car replacement (for new cars < 12 months old) |

✓ |

✓ |

✓ (< 24 months old) |

Repairs for your car |

Authorised Repairer |

Authorised Repairer (double excess for non-approved repairer) |

Any Repairer |

Windscreen excess |

S$100 |

S$100 |

S$0 |

Medical Expenses |

S$500 |

S$2,500 |

S$5,000 |

Additional Excess for young and/or inexperienced drivers |

S$2,500 |

S$2,500 |

S$0 |

Damage to third party’s property (up to S$5 million) |

✓ |

✓ |

✓ |

eCall Assistance service |

- |

- |

✓ |

Low NCD Penalty (10%) upon claims |

- |

✓ |

✓ |

Aviva’s Motor Prestige plan comes with something special: eCall Assistance. This is a physical plug-in that fits into your vehicle’s 12V outlet. This plug-in is a smart sensor device, that when connected with the ‘Aviva eCall Assistance’ app, will provide you with an emergency hotline to Aviva at your fingertips.

When the smart sensor device detects a car crash, it automatically alerts Aviva’s emergency team, who will call and send help to the scene immediately. This is especially useful should the accident be severe and you’re not able to dial for help; the sensor plug does all the work for you!

Aviva is also well-known for having the lowest NCD penalties in the market. Instead of deducting the standard 30% from your NCD when you make a claim, Aviva deducts only 10% of your NCD! This doesn’t mean that you can repeatedly crash your car, though. Your NCD may be reduced, but your premium could very well increase.

Of course, Aviva has their own set of add-ons. Let’s take a look at them:

Add-On |

Description |

NCD Protector |

Protects your NCD in event of a claim. |

Courtesy Car |

Free of charge for up to 10 days while your car is being repaired at the workshop. |

Replacement locks and keys |

Coverage for loss of car keys, replacement of locks and affected parts of the car’s alarm system. |

Additional Personal Accident Cover |

Coverage up to S$100,000 for yourself and/or any passengers in the car. |

7. AXA Insurance

(Photo Credit: AXA SG)

Our last contender on this list, AXA offers a whopping seven insurance policies for you to choose from, all of which are Comprehensive plans! Under the SmartDrive family, they are split into two categories: ‘Essential’ and ‘Flexi’.

Essential Plans

Name of Plan |

What It Covers |

SmartDrive Essential |

Basic comprehensive coverage for your vehicle. |

SmartDrive Essential+ |

Similar to Essential, but with Daily Transport Allowance, Medical and Dental expenses, and Car Protector |

SmartDrive Peace of Mind |

Similar to Essential+, but with higher flood protection and coverage for loss of personal items |

SmartDrive For Her |

Similar to Peace, but with phone assistance and roadside support |

Flexi Plans

Name of Plan |

What It Covers |

SmartDrive Flexi |

Similar to Essential, but your choice of workshop |

SmartDrive Flexi+ |

Similar to Flexi, but with more perks |

SmartDrive Flexi Family |

Similar to Flexi+, but provides complete family protection |

For more info about these plans, please visit AXA’s website.

AXA recommends the ‘Peace of Mind’ insurance plan, given that is has the most perks. ‘For Her’, as mentioned in the title, is catered towards female drivers who would prefer more assistance. Here’s a comparison chart of all the benefits of each plan:

(Photo Credit: AXA Insurance)

(Photo Credit: AXA Insurance)

The chart may look daunting, but don’t worry too much! Think of it as a game of Bingo – this will make it easier to decide which insurance policy you should apply for.

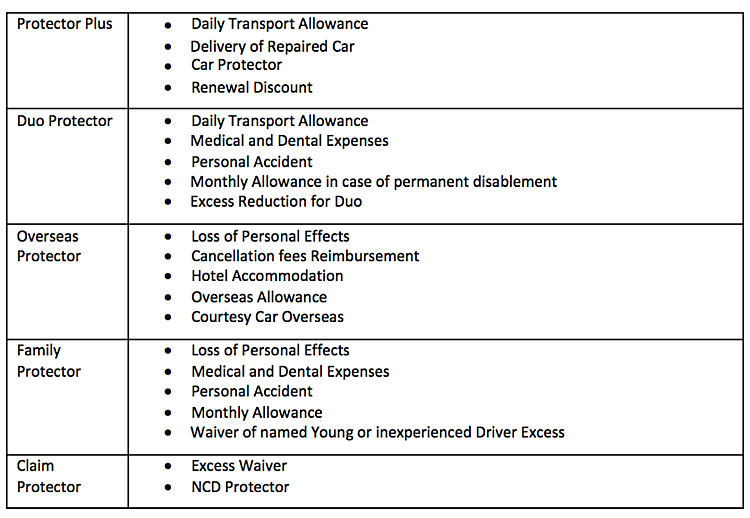

Aside from the extensive coverage that each plan offers, AXA does have its list of add-ons. The add-ons come a la carte or bundled up into 'Value Packs'. We’ll talk about the individual add-ons first.

Add-On |

Description |

Zero Excess |

Waives the basic excess. |

Double Excess |

Doubles the basic excess, resulting in a lower premium. |

Courtesy Car in Singapore |

A replacement car to drive for when your own car is in the workshop (up to 10 days). |

Personal Accident for Driver |

Coverage of up to S$500,000 in the case of permanent disablement or death (for main and named drivers). |

Car Protector |

Receive 110% of your car’s market value in the event of total loss. |

Car Accessories |

Coverage of up to S$2,000 in the event of damage or loss while protecting your NCD. |

Phone Assistance & Roadside Support |

24-hour phone assistance and/or roadside support for car breakdowns and accidents. |

NCD Protector |

Protects NCD of 30% and above (for all types of claims). |

Personal Accident for Passengers |

Coverage of up to S$20,000 in the case of permanent disablement or death for passenger(s). |

Monthly Allowance |

S$3,000 for up to 18 months. |

(Photo Credit: AXA Insurance)

(Photo Credit: AXA Insurance)

AXA’s buffet of offers is both a blessing and a curse. It’s good for those who love customization and want to tailor their insurance policies to perfectly suit their needs, but it’s also a struggle for indecisive people as they won’t know what to pick.

Some other companies that offer motor insurance that weren't mentioned in this article:

- BudgetDirect

- AIG

- Ergo

- Sompo

- China Taiping

- HL Assurance

- Tokio Marine

- India International Insurance (III)

In conclusion, picking an insurance policy is really up to personal preference and budget. Each of these insurance companies provide an Online Quotation System for you to try out, but if it seems like too much work, why not contact Motorist?

Just submit your vehicle details via the form on this page or through the Motorist App and our consultant will help you find the most competitive quotes from different companies on your behalf!

I want to find the most affordable car insurance plan within 24 hours!

Read More: What Your Car Insurance Policy Doesn’t Cover

Download the new Motorist app now. Designed by drivers for drivers, this all-in-one app lets you receive the latest traffic updates, gives you access to live traffic cameras, and helps you manage LTA and vehicle matters.

Did you know we have a Motorist Telegram Channel? Created exclusively for drivers and car owners in Singapore, you can get instant info about our latest promotions, articles, tips & hacks, or simply chat with the Motorist Team and fellow drivers!