Car Warranty vs Car Insurance: What's the Difference?

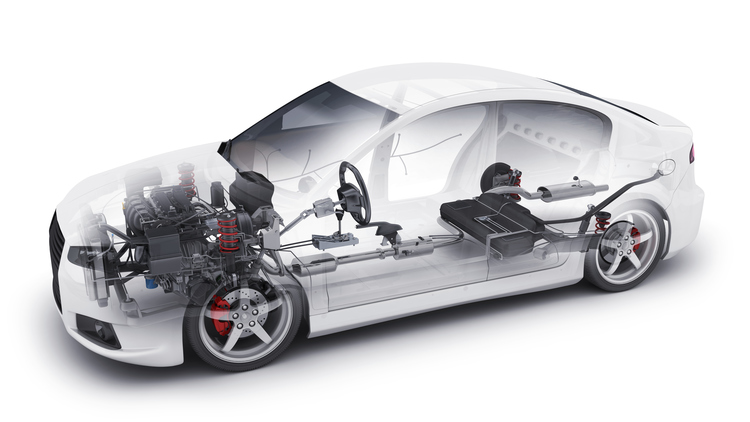

(Photo Credit: KGC Workshop)

(Photo Credit: KGC Workshop)

A car warranty and car insurance are two different ways to protect the vehicle and its owner. While they do offer a peace of mind in the event of an accident or breakdown, they vary in terms of coverage and requirements.

In general, a car warranty covers certain types of problems that your car might encounter, such as mechanical breakdowns and defects.

While car warranties are optional, they do help to offset any additional costs for repairs or replacements. For example, an engine overhaul for a Toyota Sienta can cost up to $6,000! If your vehicle is covered under a warranty, it is likely you won’t have to pay a cent for it.

On the other hand, it is mandatory for all motorists in Singapore to buy a form of insurance, as it protects them and other road users. Depending on your type of insurance, it can even cover theft or damages caused by floods or other disasters.

We will now provide you with an explanation of some of the key differences between a car warranty and car insurance.

Car Warranty

(Photo Credit: iStock)

As mentioned previously, a car warranty helps cover mechanical breakdowns and failures caused by normal wear and tear, defects, and poor maintenance.

It does not, however, cover routine maintenance, oil changes, and replaceable parts as these items naturally wear over time. Some examples include tyres, wiper blades, and brake pads.

A car warranty won’t cover breakdowns due to human negligence either. For example, when a driver chooses to ignore an overheating engine and carries on driving. Any damage sustained by this negligence won’t be covered.

Unlike car insurance, a car warranty is transferable, meaning the new car owner will enjoy the same warranty benefits as you. This increases the value of your car if you do decide to sell it.

Furthermore, unlike car insurance, you can’t cancel and refund a warranty.

(Photo Credit: KGC Workshop)

There are typically two types of warranties available - a new car warranty, which is issued by the car’s manufacturer, and a used car warranty, which can be bought from a third party such as a workshop.

A new car warranty programme covers a new car for up to 3, 5 or 10 years as standard after purchase, while a used car warranty may cover used cars that are up to 15 years old or less than 260,000km in mileage.

Depending on your warranty provider, there will be other requirements as well. For example, your car will be required to undergo a pre-inspection in order to meet the warranty requirements and standard. In addition, there might be a limit for mileage coverage as well.

For example, KGC Workshop allows claims according to the warranty period or mileage (whichever comes first):

6 months - 15,000km

12 months - 25,000km

24 months - 50,000km

36 months - 75,000km

However, it is only offered to customers who just bought a second-hand car without an existing warranty and are subjected to the vehicle's pre-inspection status.

In some cases, there is a limited amount that you can claim annually. KGC Workshop set a $10,000 limit for most cars and $25,000 for vehicles under the supercar and luxury categories.

Car Insurance

(Photo Credit: Pexels)

As stated above, car insurance is mandatory for all motorists in Singapore. It can be purchased annually and the premium for it will vary depending on several factors.

There are three types of car insurance plans available in the market; Comprehensive, Third-Party, Fire and Theft (TPFT), and Third-Party Only (TPO).

TPO is the most basic plan covering costs associated with you for damaging someone's car and their medical expenses. TPO is attractive for anyone looking for a cheap car insurance plan.

TPFT is a middle-tier plan that extends coverage to losses due to accidental fires and theft.

Lastly, a comprehensive car insurance plan is a top-tier policy. As the name suggests, it covers anything under the sun, including accidental damage and medical expenses to yourself and other parties. It also includes damages caused by disasters such as floods.

Do note that if a car is still being financed, it is required to undertake a comprehensive insurance policy. This protects the finance company in the event the car is written off as a total loss after an accident.

Car insurance will not cover mechanical breakdowns or defects. Meaning if your car is unable to start one day, you will not be able to make claims under your insurance.

Last but not least, your car insurance follows you instead of the car, so if you happen to change cars, you will enjoy the same insurance coverage as before.

Here is a table that summarises the key differences between car warranty and car insurance:

|

|

Car Insurance |

Car Warranty |

|

Legally required |

Yes |

No, underwritten by MAS regulated insurance company. |

|

Covers breakdowns |

Optional extra for most policies. |

Yes, standard for car warranty programmes. |

|

Coverages on damage claims |

Car parts related to the impact of the accident. In other words, depending on the severity of the damage done to the car. |

Car parts listed in the warranty booklet - Terms and Conditions apply according to the type of coverage. Examples are new car coverage and pre-owned car coverage. |

|

Vehicle age and mileage |

No, it depends on the type of insurance plan purchased and the claim amounts. |

Yes. For pre-owned cars, you are entitled to make warranty claims within 36 months or 75,000km (whichever comes first). |

|

Purchase with vehicle loan |

No, you will have to top up separately. |

Yes, can be part of the vehicle purchase price. |

|

Transferable ownership |

Not transferable. |

Transferable upon selling or purchasing a vehicle (limit to one time only). |

|

Type of coverage |

|

|

|

Repair at authorised workshop |

Yes, unless you purchased “any workshop” plan or it’s a third-party claim. |

Yes, compulsory to repair at authorised workshops, including any accident claims. |

|

Are aftermarket parts covered? |

Yes, additional body kits and car accessories are claimable. |

No, it will be voided by warranty, unless it is declared beforehand (applicable to some aftermarket parts only) |

Conclusion

Both a car warranty and car insurance are designed to protect the vehicle owner and offer them a peace of mind while driving, but each applies to different scenarios.

A car warranty ensures you’ll never be stuck with an expensive repair bill in the event of a breakdown, while a car insurance will cover any damages in the event of an accident.

If you consider how common car breakdown occurs, especially in the later years of a car’s life, a car warranty is definitely worth getting to help you cover the cost of expensive repairs. Not to mention, it can even increase the valuation of your car.

If you are looking for a car warranty, feel free to have a chat with us about our warranty programme. Covered by KGC Workshop, we provide affordable warranties for all car makes and models.

Alternatively, you may also speak to us to find an insurance policy to meet your needs. Simply submit your details here, and we will help you find the best motor insurance policy at the most affordable priceI want to find the most affordable car insurance plan within 24 hours!

Read More: Refinancing Car Loan to Improve Your Total Debt Servicing Ratio

Download the new Motorist App now. Designed by drivers for drivers, this all-in-one app lets you receive the latest traffic updates, gives you access to live traffic cameras, and helps you manage LTA and vehicle matters.

Did you know we have a Motorist Telegram Channel? Created exclusively for drivers and car owners in Singapore, you can get instant info about our latest promotions, articles, tips & hacks, or simply chat with the Motorist Team and fellow drivers.